On April 26, Dalian Jifa Rim Bohai Container Transport Co., Ltd. (DBR) was entrusted by Guangzhou Gaoyuesi Trading Co., Ltd. to carry a batch of steel products. Under the guidance of Bayuquan Customs, which is affiliated to Dalian Customs, it successfully completed the export declaration and customs transfer. Procedures, loading at Bayuquan Port in Yingkou, and transport to Dayaowan Port in Dalian Free Trade Zone via the DBR Bohai Rim Inner Branch Line, and it is planned to be sent to Malaysia on May 2. After the shipment of this batch of goods departs from Bayuquan Port, Guangzhou Gaoyuesi, the owner of the goods, can submit an application for tax refund at the port of departure to the local competent tax department on the same day, marking the first order in Northeast China to take Dayaowan Port as the center since Dalian was approved for the pilot project of the port of departure tax refund policy. The port of departure tax refund service at the port of departure is officially launched.

The relevant person in charge of Guangzhou Gaoyuesi Trading Co., Ltd. told reporters: "In the past, these export transit goods had to go through the actual departure from Dalian before the tax refund could be processed. After the ship, you can apply for export tax rebate in advance, and the estimated tax rebate amount is more than 93,000 yuan, which can save 7 days of tax rebate cycle. This will undoubtedly speed up the company's capital turnover and increase our confidence in expanding overseas markets."

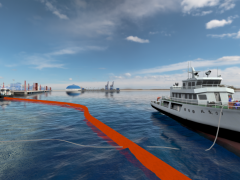

Recently, the Ministry of Finance, the General Administration of Customs, and the State Administration of Taxation jointly issued the "Notice on Expanding the Implementation Scope of the Pilot Tax Refund Policy at the Port of Departure" (Cai Shui [2023] No. Sakaiminato implements a tax refund policy at the port of departure. The 11 major ports around the Bohai Sea that have been approved as supporting departure ports for Dayaowan Port include Yingkou Port, Qinhuangdao Port, Tangshan Port, Tianjin Port, and Yantai Port.

The port of departure is approved to implement the tax rebate policy at the port of departure, which can achieve mutual benefits and win-win results for export enterprises, ports of departure, and ports of departure.

For export enterprises:

it greatly saves the transit time of goods from the port of departure to the port of departure, and the time of berthing at the port of departure, waiting for loading, going through departure procedures, and changing to ships for international voyages, effectively speeding up the capital turnover of enterprises and improving The economic benefits of enterprises will enhance the vitality of international trade.

For the port of departure:

direct tax rebate for foreign trade container goods departing from the port of departure, export enterprises shorten the tax refund cycle, speed up capital turnover, and are more willing to handle exports from the nearest port of departure, increasing the cargo throughput of the port of departure and the efficiency of port logistics distribution.

For the port of departure:

foreign trade container goods departing from the port of departure can only apply for export tax rebates at the port of departure if they leave the country through the corresponding port of departure, which can effectively improve the intercommunication between the port of departure and the port of departure The scale of container business, as the port of departure, the volume of transshipment cargo at Dalian Dayaowan Port will greatly increase.

"According to the new characteristics of the pilot tax refund at the port of departure, the Dalian Municipal Government made a unified dispatch, and the relevant departments of the Dalian port coordinated and cooperated to complete the customs clearance guarantee work such as cross-customs area joint investigation of the customs system declaration data and the filing of transportation vehicles in advance. Focusing on optimizing port services, promoting information sharing, Help speed up customs clearance and speed up tax refund processing, focus on improving the level of port customs clearance facilitation, make every effort to create an optimal port business environment, and promote the implementation of the pilot tax refund policy at the port of departure." Lin Zhengkui, deputy director of the Dalian Port Office, introduced.

As the location of Dayaowan Port, the Dalian Free Trade Zone will, under the support and guidance of Dalian Customs, the Municipal Port Office, the Municipal Taxation Bureau, the Municipal Finance Bureau and other departments, carry out extensive publicity and lectures, attract shipping and attract goods, and dynamically monitor the operation of policies. Assess, support the expansion and strengthening of the inner feeder lines around the Bohai Sea, further enhance the competitiveness of Dalian Port and ports in Japan and South Korea, amplify the role of Dalian as a portal for opening up to Northeast Asia and integrating into RCEP, create a better business environment for ports, and promote the construction of a new opening to the outside world. highlands.

Text: Edited by the Economic Development Bureau

: Party and Mass Work Department